Corporate Tax in the UAE – What you need to know today: Key Takeaways

Corporate Tax in the UAE What you need to know today Webinar - Full Video

Introduction

Let’s take a moment to understand why we chose this topic. We are sure you all have read the Corporate Tax and realized that couple of clarifications are required in some places.Cabinet Decision and Ministerial Decision will be released soon.

To provide additional clarity, we decided that while we await their decision, we could start laying the groundwork.

This webinar will help you prepare for the implementation of the corporate tax.

Topics

- Transitional Rules and Way forward

- Transfer Pricing

- Tax Technology

Transitional Rules and Way forward

The Corporate Tax Law has 70 articles divided into 20 chapters. Cabinet Decision or Ministerial Decision is expected to provide additional clarification.

While we wait for the Cabinet Decisions and Ministerial Decisions, it would be appropriate to discuss the requirements that might assist you in your preparations for the implementation of corporate tax within your organisation well in advance of your respective first tax year.

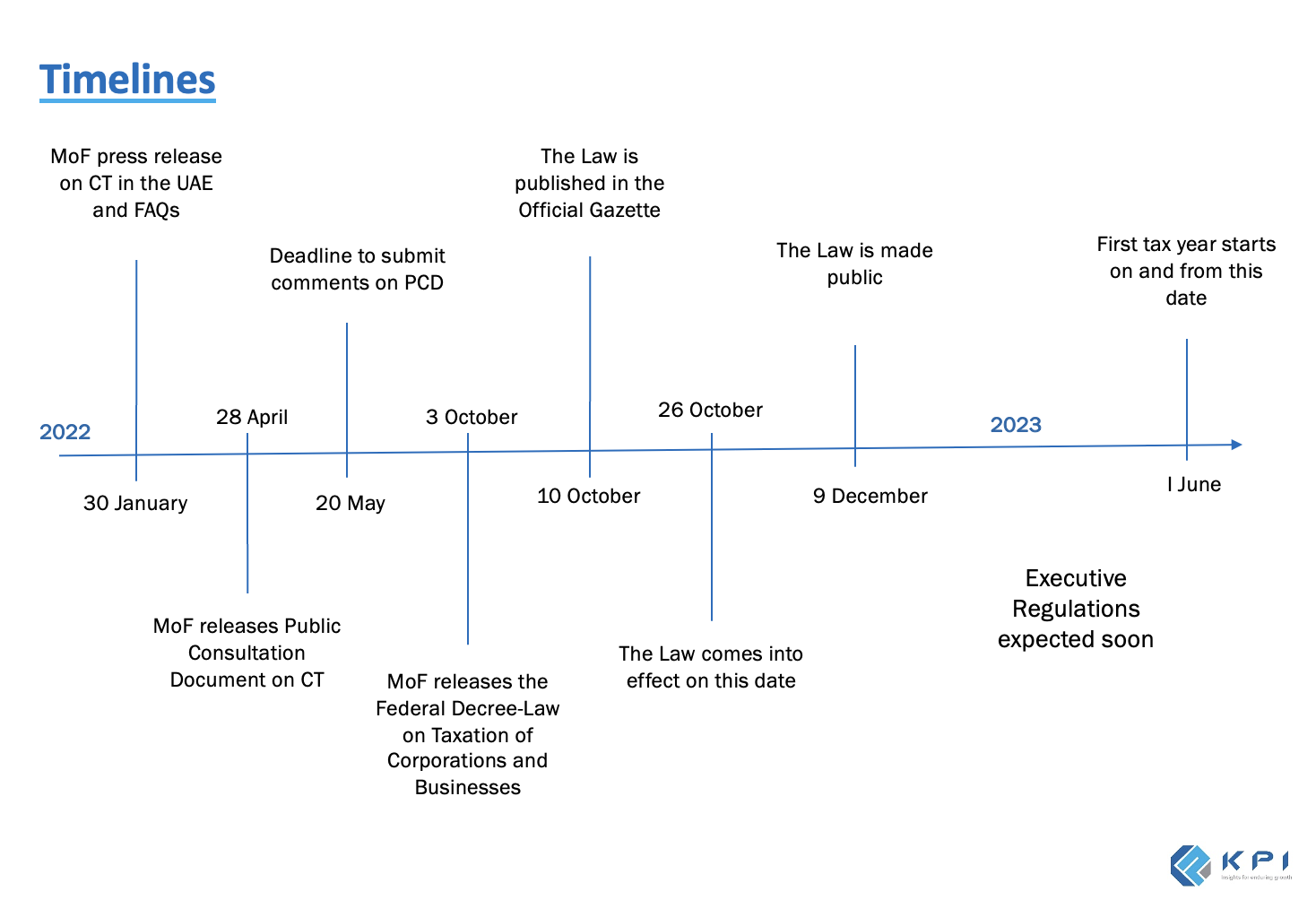

Let’s begin with the various dates associated with the Corporate Tax in the UAE

Timeline

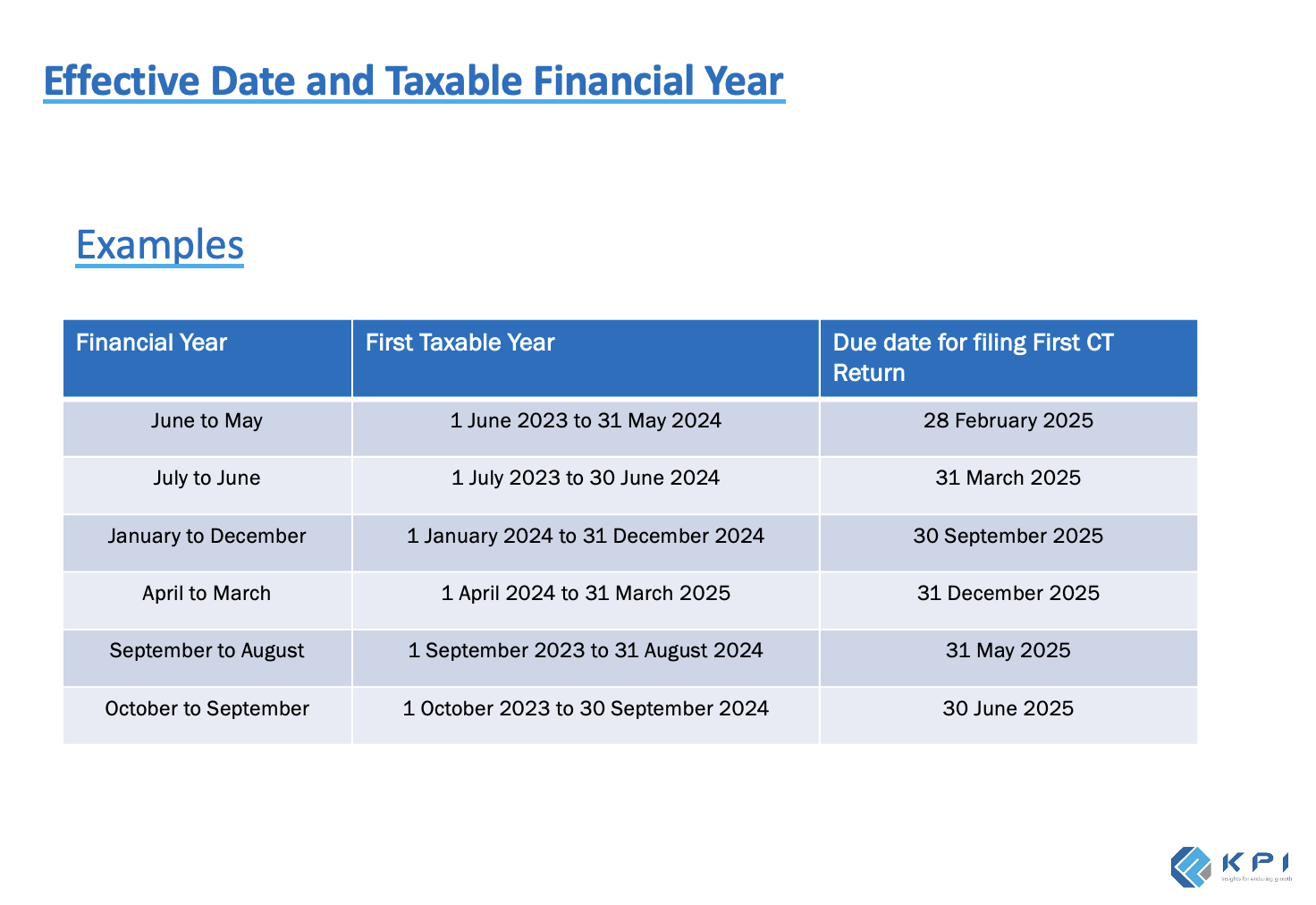

Effective Date and Taxable Financial Year

Corporate Tax is proposed to be implemented from the financial year beginning on or after 1 June 2023

Corporate Tax Return is required to be filed on or before 9 months from the end of the financial year of taxable person

Transitional Rules

- Opening Balance Sheet

- Applicable Accounting Standards

- Arm’s Length Principle

- General Anti-Abuse Rules (GAAR)

What are the next steps?

While we are still waiting for the Executive Regulations, we MUST start with the groundwork and be ready before the first taxable year

- Review the corporate structure

- Identify and review the Income stream

- Identify and review the expenses

- Relook and update the chart of accounts and accounting system

- Analyze the benefits of Group registration viz.a.viz standalone

- Training to relevant staff

Transfer Pricing in the UAE

The UAE CT framework also includes a comprehensive Transfer Pricing regime. Transfer Pricing or Arm’s Length Principle means that the transactions between related parties and with connected persons need to be at a similar rate as if they are being undertaken between independent parties.

The main idea of Transfer Pricing regime is to avoid shifting of tax base to a low tax jurisdiction.

Transfer pricing Articles in the Law

- Article 1 - Definitions

- Article 34 - Arm’s Length Principle

- Article 35 - Related Parties and Control

- Article 36 - Payment to Connected Persons

- Article 55 - Transfer Pricing Documentation

Transfer Pricing Policy – One Step Ahead

To manage our future Transfer Pricing compliance-related risks

- TP Policy is a document that analyses the transfer pricing arrangements, such as risk and functional analyses, prices, and terms and conditions

- Determines in advance whether the intercompany transactions meet the arm’s length principle and if not then what it the arm’s length standard

The objective of Transfer Pricing Policy

- Harmony

- Compliance

What are the next steps?

While we await the Executive Regulations, we suggest taxpayers to start the groundwork for implementation of transfer pricing

- Review the intercompany arrangements;

- Determine the related parties and connected persons;

- Determine the transactions to which transfer pricing will apply;

- Prepare transfer pricing policy to ensure the intercompany transactions will meet the arm’s length standard

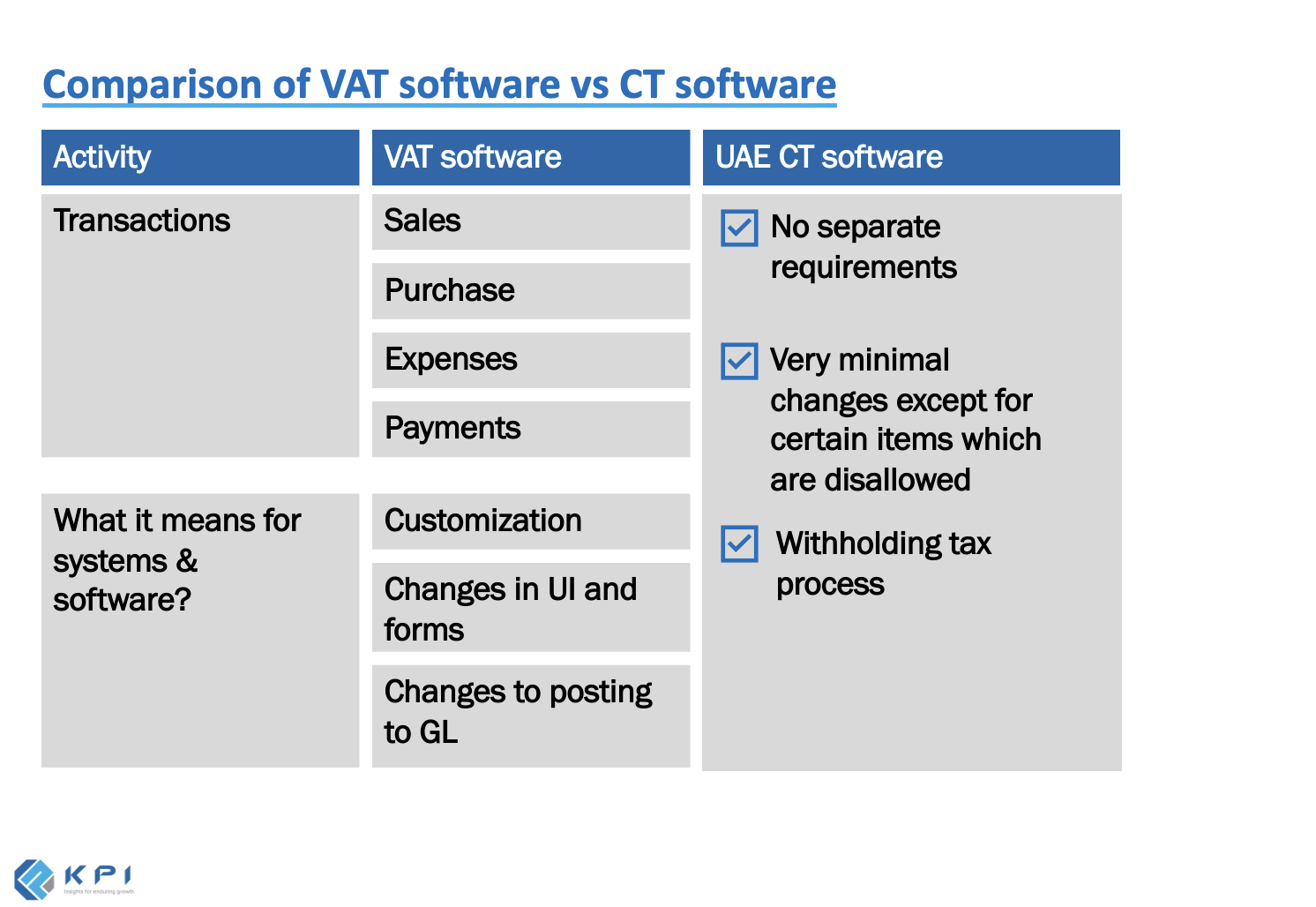

Tax Technology

We are all preparing for the UAE corporate tax regime. Understanding the law, understanding the rules and regulation is the first step at the same time it’s very important that we also understanding the technological aspect of the requirements. Some of the most frequently asked questions coming from everywhere is as follows.

Do I need a new software or upgrade or tax engine or do I need a plug in?

Is my current software good enough and can I modify it or customize it to comply with the requirements?

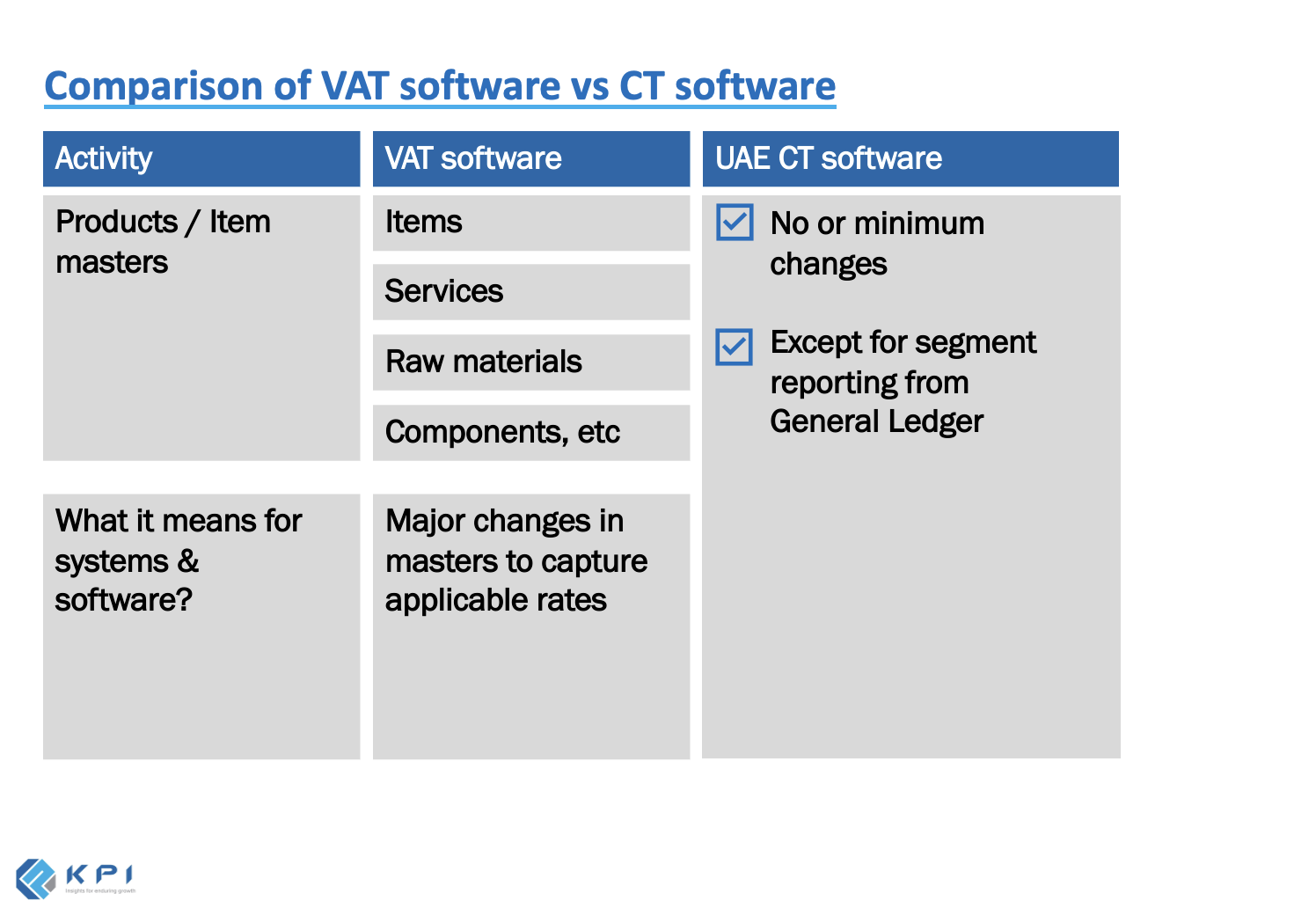

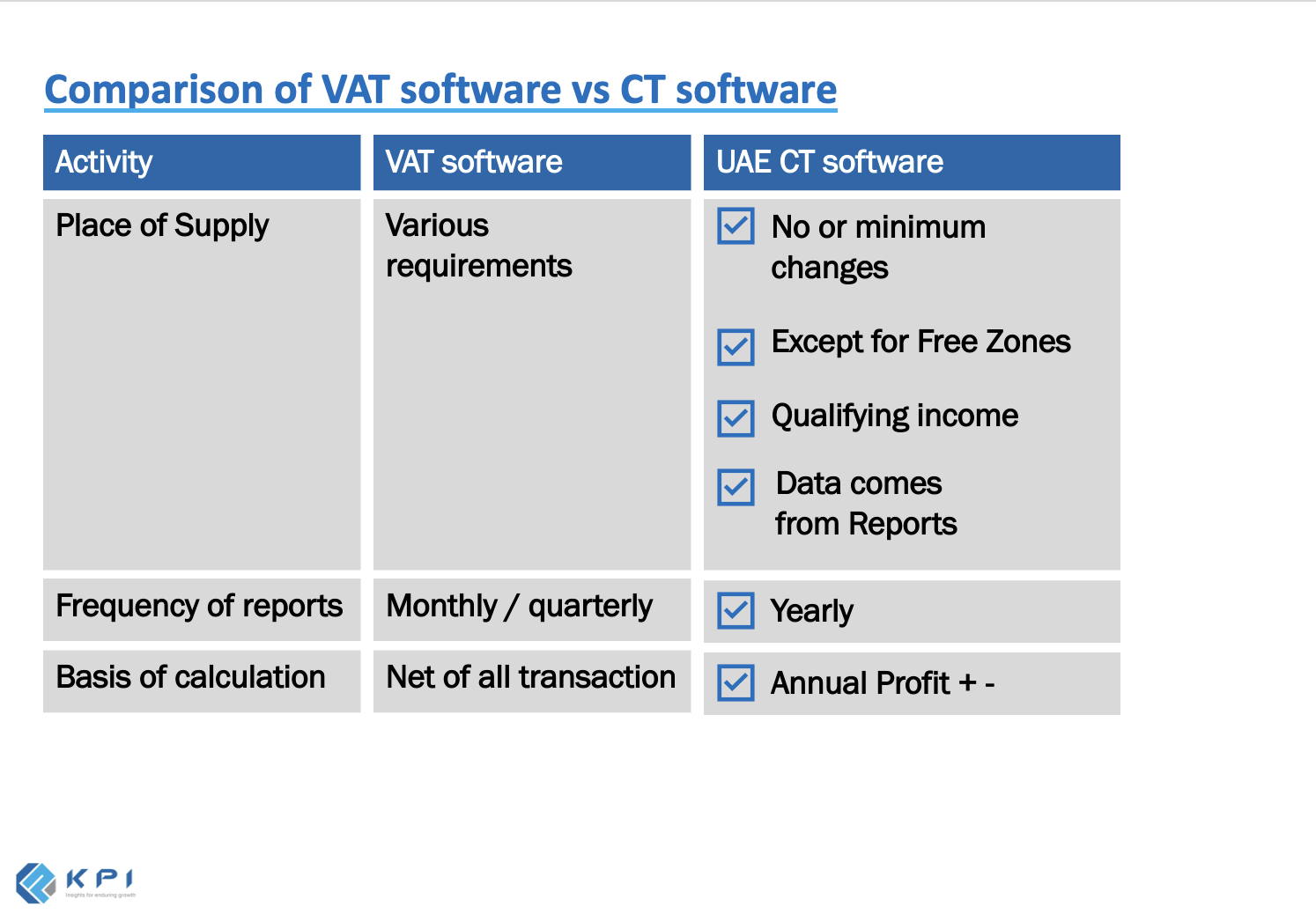

Comparison of Tax software for Direct Tax vs Indirect Tax

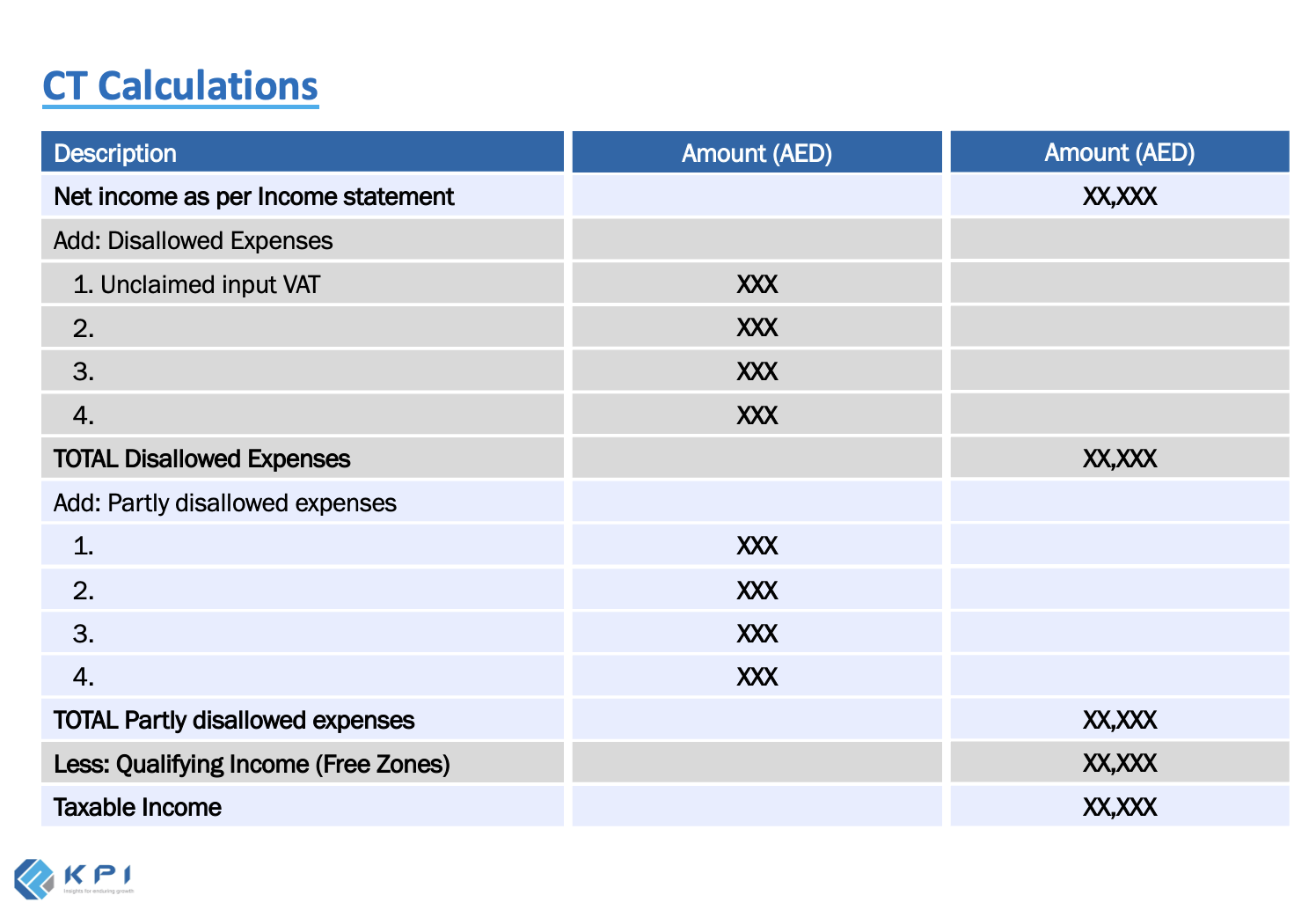

CT Calculations

Net profit as per the income statements, and we will add back all the expenses which is disallowed. Say for example as per the UAE CT law, the input VAT which is unclaimed is added back. We all will add back partial disallowed expenses minus the qualifying income or income attributing to freezones which are qualified income. Thats how we arrive at the taxable income.

How these Additions and deductions Items will be obtained?

- Restructure the Chart of account

- Redesign the process to capture and report the required data

- Modify or customize UI / forms

It is time for businesses to consider the impact of the newly introduced Corporate Tax. Our tax experts at KPI would be happy to guide you on what actions you need to take to follow the law, once it becomes effective.

Send Inquiry